The Importance of Retirement Planning and How to Get Started

In today’s world, retirement planning is not just a financial strategy; it's crucial for ensuring that you and your family can maintain a stable lifestyle in retirement. As life expectancy increases and societal structures evolve, effective financial planning is becoming increasingly necessary to address the economic challenges of retirement. Retirement planning impacts not only financial security but also quality of life, mental well-being, and long-term family stability. This article explores why retirement planning is essential for everyone and offers practical advice on how to start creating a solid retirement plan.

Why is Retirement Planning Important?

1. Increased Life Expectancy and Early Retirement Age: Advances in medical technology and increased health awareness are leading to longer lifespans, which means you need financial support for a longer period during retirement. Additionally, many countries are raising the official retirement age, requiring more financial preparation to achieve economic freedom in retirement.

2. Pressure on Social Pension Systems: Many countries' social pension systems are facing challenges due to an aging population and financial sustainability issues. These systems may not provide enough benefits to cover all retirees' living expenses, making personal retirement savings crucial.

3. Increased Personal Financial Responsibility: Modern society emphasizes individual financial responsibility and autonomy, so people need to rely on their own savings and investments to ensure a sufficient standard of living in retirement.

4. Economic Uncertainty and Changing Employment Trends: Globalization and technological advancements bring economic changes and uncertainties, making career and income sources less stable. A well-structured retirement plan helps accumulate wealth during stable career phases to prepare for potential future needs.

Supporting Data:

• The U.S. Bureau of Labor Statistics predicts that by 2040, people aged 65 and older will make up nearly 23% of the total population.

• According to OECD reports, most developed countries' pension expenditures may face sustainability issues due to aging populations.

• Surveys show that increasing numbers of individuals and families globally are relying on personal savings and investments to achieve financial security in retirement.

Benefits of Retirement Planning

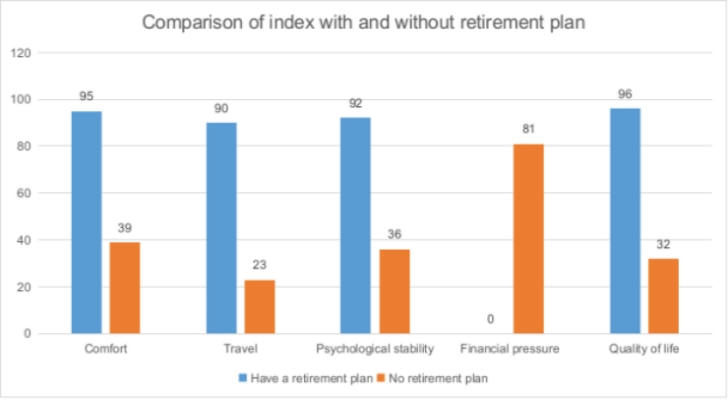

Planned retirees who prepare and manage their finances well can maintain a more stable and high-quality lifestyle in retirement, while those without a plan may face financial challenges. Here are some benefits of having a retirement plan:

1. Financial Stability:

• **Planned Retirement:**Those with a plan typically accumulate enough wealth through savings and investments to support their retirement expenses. They may have multiple income sources, such as retirement accounts, pensions, and investments, which enhances financial stability.

• **Unplanned Retirement:**Those without a plan may rely solely on social security or other basic retirement benefits, which often do not cover all living expenses, leading to financial pressure.

2. Quality of Life:

• **Planned Retirement:**A detailed retirement plan allows you to continue enjoying a high quality of life and achieve retirement goals, such as travel or pursuing hobbies.

• **Unplanned Retirement:**Lack of planning can result in a decline in quality of life due to inability to cover additional expenses or handle unexpected costs.

3. Mental Health:

• **Planned Retirement:**Individuals with a retirement plan often experience better mental health due to clear planning and preparation, helping them handle life’s challenges and changes more effectively.

• **Unplanned Retirement:**Lack of planning can lead to anxiety and stress, especially when facing financial difficulties or unforeseen expenses.

4. Flexibility and Adaptability:

• **Planned Retirement:**Those with a plan can adapt their financial strategies and lifestyle based on changing economic conditions or personal circumstances.

• **Unplanned Retirement:**Without a plan, individuals may face greater difficulties due to a lack of flexibility in handling unexpected situations or financial problems.

Common Retirement Planning Mistakes and How to Avoid Them

Effective retirement planning involves starting early, accurately estimating expenses, diversifying investments, regularly reviewing your plan, and managing risks. Here are common mistakes and how to avoid them:

**1. Underestimating Expenses:**Accurately estimate retirement living costs to avoid underestimating future expenses.

**2. Over-relying on Social Security:**Social security alone may not cover all expenses; supplement it with personal savings and investments.

**3. Ignoring Health Insurance and Medical Costs:**Plan for health insurance and medical expenses in advance to handle future health issues.

**4. Not Reviewing the Plan Regularly:**Regularly review and adjust your retirement plan to adapt to changing economic conditions and personal situations.

Three Simple Retirement Planning Success Stories

Case 1: Success with Early Planning

Background:

Mr. Li and Ms. Wang began planning for retirement in their 30s. They had stable jobs and good incomes.

Strategies:

1. Set Goals: They decided on their retirement age and lifestyle goals.

2. Regular Savings: They set aside a portion of their income each month into retirement accounts and investments.

3. Diversified Investments: They invested in a mix of stocks, bonds, and real estate to spread risk.

**4. Regular Review:**They reviewed their investment plan annually and made necessary adjustments.

Outcome:

By age 50, Mr. Li and Ms. Wang had reached their savings target. They were able to retire early at 60 and enjoyed traveling and pursuing hobbies. Their early planning ensured a secure and fulfilling retirement.

Case 2: Success with Flexible Adjustments

Background:

Mr. Zhang started focusing on retirement planning at 40 but experienced several job changes and fluctuating income.

Strategies:

**1. Emergency Fund:**He created a flexible plan with an emergency fund to handle income variations.

**2. Adjust Savings:**Saved more during high-income years and less during low-income periods, but maintained consistent savings.

**3. Investment Adjustments:**Regularly adjusted his investment portfolio based on market conditions and personal risk tolerance.

**4. Healthcare Planning:**Set up a long-term healthcare insurance plan.

Outcome:

Despite income instability, Mr. Zhang achieved his financial goals through flexible planning. By age 65, he retired comfortably and managed to cover healthcare expenses, leading a stable and enjoyable retirement life.

Case 3: Success with Late Planning

Background:

Ms. Liu only began serious retirement planning at age 50 when her financial situation was not ideal.

Strategies:

**1. Reduce Debt:**Developed a plan to reduce debt and increase savings.

**2. Boost Savings:**Maximized savings and took on part-time work to increase income.

**3. Seek Help:**Hired a financial advisor to create an investment strategy.

**4. Gradual Transition:**Shifted from full-time to part-time work to ease into retirement.

Outcome:

Though she started late, Ms. Liu's efforts and professional advice allowed her to meet her retirement goals. Although she didn’t retire early, she achieved a comfortable retirement at 65 and enjoyed quality time with her family.

These three cases illustrate that whether you plan early, adjust flexibly, or make late efforts, careful planning and execution can lead to a successful and happy retirement.

In summary, retirement planning is crucial for ensuring economic security and maintaining a high quality of life. It also affects mental health and life satisfaction. By planning early and making ongoing adjustments, you can ensure sufficient funds to support daily living and anticipated expenses in retirement, while minimizing financial stress. Start now to prepare for a secure and fulfilling retirement. Set clear goals, assess your financial situation, choose appropriate investment strategies, and regularly review and adjust your plan to enjoy the retirement life you envision.