Where to Find Interest-Free Loans in the USA

"The best loan is one that doesn’t cost you extra." – Anonymous.

In the United States, almost all loans come with interest, as lenders need to make a profit. However, in certain cases, you can qualify for an interest-free loan (0% APR Loan), meaning you can borrow money without paying extra in interest. These loans are often provided by nonprofit organizations, government programs, banks, and private companies for specific purposes such as medical expenses, emergency aid, or purchasing a vehicle.

This guide explores various types of interest-free loans available in the USA, including eligibility requirements, benefits, and application links.

1. Government and Nonprofit Organization Interest-Free Loans

Some government programs and nonprofit organizations offer interest-free loans to individuals in financial need. These loans can help cover emergency expenses, medical bills, education, or business startups.

1.1. Nonprofit Emergency Loans

Several nonprofit organizations provide interest-free personal loans for individuals facing financial difficulties. These programs are usually community-based and aim to support individuals who do not qualify for traditional bank loans.

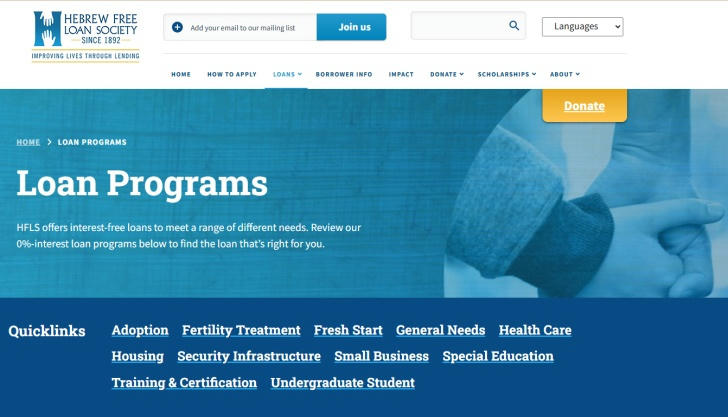

🔹 Hebrew Free Loan Society (HFLS) – Offers 0% interest loans up to $10,000 for low-income individuals to cover medical bills, education, housing, or emergencies.

Eligibility:

✔ Must demonstrate financial need.

✔ Must reside in an area served by the organization.

✔ May require a guarantor.

📌 Apply at Hebrew Free Loan Society

🔹 Mission Asset Fund (MAF) – Provides interest-free loans for immigrants, low-income individuals, and small business owners. MAF also helps borrowers build their credit score by reporting payments to credit bureaus.

Real-Life Example: How an Interest-Free Loan Helped Maria Start Her Business

Maria, a 32-year-old immigrant from Mexico, dreamed of starting her own small bakery in Los Angeles. However, with a limited credit history and no access to traditional bank loans, she struggled to secure funding.

After researching alternative financing options, Maria discovered the Mission Asset Fund (MAF). She applied for an interest-free loan and was approved for $5,000, which allowed her to purchase essential baking equipment and ingredients.

Since MAF reports repayments to credit bureaus, Maria was able to build her credit score while repaying her loan on time. A year later, she successfully expanded her bakery and now qualifies for larger business loans from mainstream lenders.

1.2. Federal Emergency Loans (FEMA)

The Federal Emergency Management Agency (FEMA) offers financial assistance, including interest-free loans for disaster victims. These loans help cover home repairs, temporary housing, and medical expenses after a natural disaster.

Eligibility:

✔ Must have been affected by a declared disaster (hurricanes, wildfires, etc.).

✔ Proof of loss or damage due to the disaster.

✔ Must not qualify for insurance coverage.

2. 0% APR Credit Cards – Short-Term Interest-Free Borrowing

If you need to borrow money short-term (6-18 months) and can pay it off before the promotional period ends, a 0% APR credit card is an excellent option. These cards allow you to make purchases and pay them back over time without interest during the promotional period.

💳 Recommended 0% APR Credit Cards (2025):

• Chase Freedom Unlimited® – 0% interest for 15 months on purchases and balance transfers.

• Citi Simplicity® Card – 0% interest for 18 months, no late fees.

• Discover it® Cash Back – 0% interest for 15 months, plus 5% cash back on select purchases.

🚀 Things to Consider:

✔ Must repay the full balance before the promotional period ends to avoid high interest charges.

✔ Does not apply to cash advances – only purchases and balance transfers.

3. Interest-Free Medical Loans & Payment Plans

Medical expenses can be overwhelming, but some healthcare providers and financing companies offer interest-free payment plans to help patients manage their bills.

3.1. CareCredit – Medical Credit Card

CareCredit is a medical financing card that provides 0% APR for 6-24 months for approved healthcare services, including:

✅ Doctor visits

✅ Dental care

✅ Vision care (glasses, LASIK, etc.)

✅ Veterinary expenses

Eligibility:

✔ Requires a fair credit score (580+).

✔ Must use the loan for healthcare-related expenses.

4. 0% APR Auto Loans – Interest-Free Car Financing

If you’re planning to buy a car, some automakers offer 0% financing promotions for qualified buyers. This means you can get an auto loan with no interest over a fixed term (usually 24-72 months).

🚗 Brands That Frequently Offer 0% APR Financing (2025):

• Toyota

• Honda

• Ford

• Chevrolet

💡 Important Considerations:

✔ Requires excellent credit (700+ score) to qualify.

✔ 0% APR may only be available for specific models or shorter loan terms.

✔ Check for hidden fees or mandatory add-ons.

📌 Check for 0% APR Auto Loan Offers

5. Buy Now, Pay Later (BNPL) – Interest-Free Installments

If you’re making an online purchase and want to split payments into several months without interest, Buy Now, Pay Later (BNPL) services offer 0% financing.

🔹 Affirm – Available on Amazon, Best Buy, and Walmart for interest-free monthly payments.

🔹 Afterpay – Split purchases into 4 payments with no interest.

🔹 Klarna – Flexible payment plans with 0% APR options.

🚀 What to Watch Out For:

✔ Must pay on time to avoid late fees.

✔ Some retailers charge fees if the loan term exceeds the promotional period.

Final Thoughts: Which Interest-Free Loan is Right for You?

| Loan Type | Best For | Where to Apply |

|---|---|---|

| Nonprofit & Emergency Loans | Low-income individuals, emergencies | HFLS, MAF |

| 0% APR Credit Cards | Short-term purchases (6-18 months) | NerdWallet |

| Medical Loans | Hospital bills, dental care | CareCredit |

| 0% Auto Loans | Buying a car | Edmunds |

| Buy Now, Pay Later | Online shopping | Affirm |

If you qualify for an interest-free loan, make sure to repay on time to avoid hidden fees or penalties. Which option best fits your needs?