U.S. Pension Claiming Guide: How to Start Receiving Your Retirement Benefits

As you approach retirement, one of the most important tasks is figuring out how to claim your pension benefits. Whether you’ve paid into Social Security, have an employer-sponsored pension, or have a personal retirement account, the process of accessing these funds can seem complicated. This guide will walk you through the essential steps, eligibility requirements, and tips to help you claim your retirement benefits smoothly.

Types of Pension Benefits in the U.S.

There are three main sources of retirement income in the U.S.: Social Security, employer-sponsored pensions (like 401(k)s), and private retirement accounts (IRAs). Each has different rules and steps for claiming benefits.

1. Social Security Benefits

Social Security provides monthly payments based on the income you earned during your working years. To qualify, you must have worked for at least 10 years, earning 40 credits.

When to Claim:

You can start claiming Social Security at age 62, but your payments will be reduced if you claim before your full retirement age (FRA), which is between 66 and 67 for most people.

If you wait until age 70, your payments will be higher.

How to Claim:

You can apply for Social Security benefits online, over the phone, or in person at a local Social Security office.

It’s recommended to apply at least three months before you want your benefits to begin.

2. Employer-Sponsored Pensions (e.g., 401(k))

Many U.S. workers have access to employer-sponsored pension plans, such as 401(k)s. These plans are funded by both you and your employer, and the money grows tax-deferred until retirement.

When to Claim:

You can start accessing your 401(k) funds at age 59½ without penalties. However, you may be able to take withdrawals earlier if your employer allows it, but this could result in penalties.

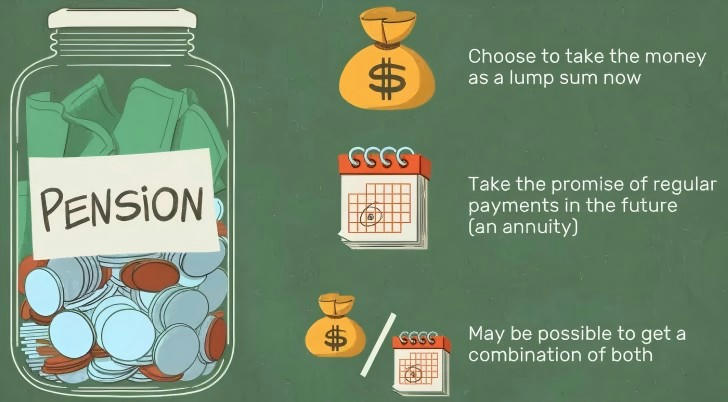

Depending on your plan, you may be able to choose between a lump sum or regular monthly payments.

How to Claim:

- To claim your 401(k) benefits, contact your employer’s HR department or pension plan administrator.

3. Private Retirement Accounts (IRAs)

IRAs are individual retirement accounts that you set up yourself. There are two main types: traditional IRAs and Roth IRAs.

When to Claim:

With a traditional IRA, you can start withdrawing funds at age 59½ without penalty. You must begin taking Required Minimum Distributions (RMDs) by age 72.

With a Roth IRA, qualified withdrawals are tax-free if the account has been open for at least five years.

How to Claim:

- Contact your IRA provider to request withdrawals. Many providers allow you to choose how you receive the money, whether in a lump sum or as regular payments.

Real-Life Example: Jane’s Retirement Journey

To make this process clearer, let’s look at Jane’s story, a 65-year-old retiree who has worked as a teacher for over 30 years.

Social Security: Jane begins her Social Security benefits at age 65. She could have waited until 66, but she chooses to start early because she needs the extra income. Her monthly benefit is $1,500, which is a reduced amount because she claimed before her full retirement age.

401(k): Jane has a 401(k) plan from her previous job. When she retires, her account balance is $150,000. She rolls over this money into a traditional IRA to avoid paying taxes immediately.

IRA Withdrawals: At age 65, Jane starts withdrawing $1,000 monthly from her IRA. She works with her financial advisor to ensure she withdraws funds in a tax-efficient way.

By carefully planning her Social Security, 401(k), and IRA withdrawals, Jane is able to cover her living expenses comfortably in retirement.

Common Questions

1. What if I’ve worked abroad?

If you’ve worked in other countries, you may still be eligible for U.S. Social Security benefits. The U.S. has agreements with several countries to ensure you can claim your benefits, but the process may be more complex. Be sure to keep track of your pension records from both the U.S. and any other countries where you’ve worked.

2. What happens if I claim early?

Claiming benefits early means lower monthly payments, especially for Social Security. If you claim before your full retirement age, your Social Security payments will be permanently reduced. It’s important to weigh your current financial needs against the long-term impact of a lower benefit.

3. Are pension benefits taxed?

Yes, most retirement benefits are subject to federal taxes, and in some cases, state taxes. Social Security benefits may be partially exempt from taxes, depending on your income level. It’s important to plan for the tax implications of your pension withdrawals.

Tips for a Smooth Pension Claiming Process

Start Early: Don’t wait until the last minute. Begin the claiming process several months before your planned retirement date. This gives you time to address any issues, such as missing records or discrepancies.

Know Your Benefits: Review your Social Security statements, 401(k) balances, and IRA accounts so you have a clear understanding of how much you can expect to receive.

Consult a Financial Advisor: A financial advisor can help you understand the best way to withdraw from your retirement accounts to minimize taxes and maximize your retirement income.

Stay Organized: Keep track of deadlines, especially for Social Security benefits, and make sure you understand the requirements for claiming your pensions on time.

Conclusion

Claiming your pension benefits is an essential part of your retirement planning. By understanding the different types of benefits available, knowing when and how to claim them, and working with professionals to manage your finances, you can ensure a smoother transition into retirement. Take time to plan ahead, and you’ll be well-prepared for the next chapter of your life.