How to Choose the Right Pet Insurance for Your Furry Friend

Have you ever found yourself in this situation?

One morning, you notice your dog is acting lethargic and not eating, so you rush them to the vet. The doctor tells you that your pet needs X-rays, tests, or even surgery. When the bill arrives, your heart races—hundreds, even thousands of dollars, far beyond your budget!

This isn’t an exaggeration. In the U.S., veterinary costs are skyrocketing, especially in the case of accidents or serious illnesses. Research shows that the average cost for emergency veterinary care can reach up to thousands of dollars. But the good news is, if you choose the right pet insurance plan ahead of time, these unexpected costs can be significantly reduced.

So, how do you find the best insurance for your pet? Don’t worry, this article will walk you through the key considerations to help you get the most value and peace of mind for the least amount of money.

Understand Your Pet’s Needs—Don’t Buy Insurance You Won’t Use

Different pets have different health risks, so choosing the wrong insurance is essentially wasting money.

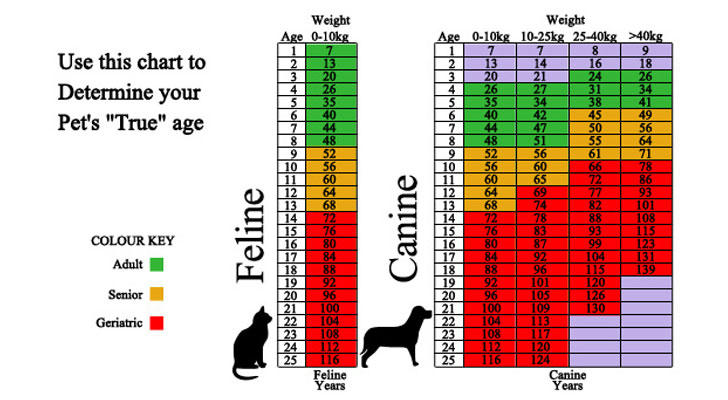

1. Age Matters

Young Pets: You might think your puppy or kitten is full of energy and won’t have health problems, but a simple stomach upset or accidental injury could cost you a lot! At this stage, it’s crucial to choose insurance that covers accidents and common illnesses.

Senior Pets: As your pet ages, they may develop chronic conditions like arthritis or heart disease. Having insurance that covers these issues is essential for long-term care and peace of mind.

2. Breed-Specific Issues

Some breeds are more prone to certain health problems. For example, French Bulldogs are prone to respiratory issues, while Golden Retrievers are more likely to experience skin problems. Be sure to choose insurance that covers these breed-specific health risks.

💡 Pro Tip:

If you have an adventurous pet, like a Husky that’s always running into things, make sure you choose an insurance plan with comprehensive accident coverage!

Avoid the Pitfalls of Complicated Terms

The last thing you want is to think you’re covered, only to find out later that the insurance won’t pay for your vet bill.

Common Pitfalls to Watch Out For:

Waiting Periods: Some policies have waiting periods, meaning coverage won’t kick in until 30 days after you enroll.

Exclusions: Conditions like genetic disorders or pre-existing conditions may not be covered.

Payout Limits: While some policies may offer high reimbursement rates, they may have an annual payout limit that doesn’t cover all costs.

💡 Smart Advice:

Look for insurance plans that are transparent about their claims process and have minimal exclusions. For example, Trupanion allows you to pay directly at the vet's office, without having to pay upfront and wait for reimbursement.

How to Quickly Find the Right Insurance Plan? Compare These Key Factors!

- Premiums and Reimbursement Rate:Compare the monthly premium with the reimbursement rate (usually 70% to 90%).

- Coverage Scope:Make sure the plan covers accidents, illnesses, chronic conditions, prescription medications, and rehab treatments.

- Claims Process:Choose a plan with a fast, easy claims process to avoid unnecessary hassle when you need help the most.

💡 Recommended Pet Insurance Providers (U.S. Market):

Healthy Paws: High reimbursement rates (90%) + fast claims process

High Reimbursement Rate: Most plans offer up to 90% reimbursement, which can significantly reduce the burden of expensive medical costs for pet owners.

Fast Claims Process: The claims process is simple and quick, with most claims processed within a few days of submission.Trupanion: Direct vet payments, no upfront cost

Direct Vet Payments: In collaboration with vets, pet owners only need to pay the out-of-pocket portion, while the insurance company directly settles with the vet, eliminating the need for upfront payment.

No Upfront Costs: There are no additional upfront costs, making the claims process convenient.ASPCA Pet Insurance: Great for multi-pet households, offering multi-pet discounts

Multi-Pet Household Discount: If you have multiple pets, ASPCA offers discounts that are ideal for multi-pet households, helping you save on insurance premiums.

Comprehensive Coverage: Includes coverage for accidents, illnesses, medications, and rehab, ensuring that all of your pet's needs are taken care of.

These insurance companies have a strong reputation in the U.S. market, and when choosing a plan, you can decide based on your needs and your pet's situation.

Want to learn more about choosing the best pet insurance plan for your furry friend?

Click on the links below for detailed reviews and comparisons of the top providers to make an informed choice!

Real Case: How Pet Insurance Saved Thousands of Dollars

Emily’s dog, “Max,” is a 3-year-old Golden Retriever who loves to run and play. One day, while playing at the park, Max suddenly started limping. She rushed him to the vet, who diagnosed him with patellar luxation, a common knee joint issue in large dogs. The vet recommended surgery, which would cost around $4,500 to $5,000.

Fortunately, Emily had purchased pet insurance for Max when he was younger, meaning the surgery was covered. She only had to pay $500 in out-of-pocket expenses, and the insurance covered the rest. Max’s surgery went smoothly, and he recovered quickly.

Without insurance, Emily would have faced an overwhelming bill and may have had to delay surgery or consider other options. By getting insurance for Max early on, Emily not only saved thousands of dollars but also ensured Max could get the treatment he needed right away, returning to his happy and energetic self.

Are you ready to “protect” your pet with insurance too?

Peace of Mind and Savings: Pet Insurance Simplifies Everything

The real benefit of pet insurance isn’t just about medical coverage—it’s about giving you peace of mind.

Imagine if your pet had an accident or developed a serious illness, and you had to pay out-of-pocket for treatment, possibly thousands of dollars. With the right insurance, those costs become much more manageable, and you won’t have to stress over paying medical bills. With low premiums and a high reimbursement rate, insurance covers most of the cost, making it both cost-effective and reassuring.

No more worrying about huge bills, no more second-guessing treatment options—insurance is the key to staying worry-free.

Conclusion: Pet Insurance Lets You Handle Any Unexpected Situation with Ease

Pet insurance isn’t just about preparing for the worst—it’s about making sure you can handle the everyday challenges with ease. Whether it’s an emergency accident or a chronic illness, the right insurance plan helps you manage costs and provides peace of mind.

By choosing the right insurance for your pet’s needs, you’re setting up a solid foundation for their health and future, while also easing your financial burden. Medical bills for pets can never be cheap, but with insurance, they don’t have to be a financial burden.

Choosing the right insurance for your pet is the best way to ensure a healthy, happy future for your furry friend—and a worry-free one for you.

Relevant Links: Healthy Paws trupanion ASPCA Pet Insurance